The Complete Guide to Starting an LLC in California — Easy and Online!

Want to start an LLC, but you aren’t sure how?

Here is a full, step-by-step walkthrough on exactly how to register your business in the State of California as an LLC. However, if you are not sure whether an LLC is the best fit for your business, you can watch the video linked here to determine what may be best for your business.

Quick Note

Before we begin, you need to know that every piece of information that you file with your LLC paperwork is going to be on public record. This includes your address and your phone number, and this means that anyone can search and locate this information. Additionally, I am neither an attorney nor a CPA and I always recommend consulting with both to ensure you are following proper procedure and best practices for your own unique situation — this information is based on the information found on the Secretary of State’s website here

Don’t Want to File Yourself?

Below is a step-by-step guide on how to file your LLC, but if you are finding this process too overwhelming, you can seek out the help of a third party company, like Incfile, to assist you. Incfile will charge you only the state filing fees, and in most cases, they will even provide a registered agent for you for free for the first year. (affiliate link))

Things to Prepare Before Filing

Selecting a Name for Your Business

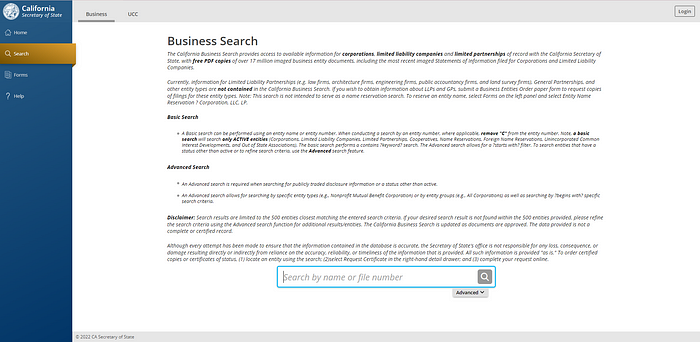

First, you will need to select a name for your LLC. While you do need to select a name for your business to have on file, you can register separate DBAs — doing business as names, also known as fictitious business names — for different branches of your business, or if you rebrand your business. Once you have a name in mind for your LLC, confirm it is not already registered on the California’s Secretary of State’s website.

Listing a Business Address

Next, you will need to decide on a business address. It is required to have a public address on file, and it must be a brick and mortar location — it cannot be a PO box. It is completely legal to use your personal home address as your business address, but you home address will now become public record — which could raise some privacy concerns. If you do not want your personal home address listen online it would be beneficial for you to utilize a separate business address.

A P.O. box is not a suitable solution for this, as the State of California needs to have an actual brick and mortar business address listed for your business. If you do not have a commercial office space, the next option is to obtain a virtual office.

A virtual office is a service that allow you to receive mail and use their brick and mortar address for your business license, in exchange for a monthly fee. You can research the virtual offices local to you, there may be a variety of options available.

Selecting a Registered Agent

Next, you will need to set up a registered agent — a registered agent is someone that represents your business. Their specific task is to receive mail and important notices for your business. Your registered agent can either be yourself, a representative from your business, or it can be a third party service that specializes in offering registered agent services.

You can become your own registered agent, but there’s a few different reasons why you might want to employ a third party service instead. Hiring a third party service allows you to retain a level of privacy and keep your personal information off of the internet. This is also a beneficial service if you will not be at your business location often. This ensures that there is always someone available to receive important notices about your business.

Submitting Your Articles of Organization

Once you’ve prepared all of those things in advance, the next step is to file your paperwork to register yourself as an LLC. You will be required to submit what is known as the Articles of Organization on the California Secretary of State website.

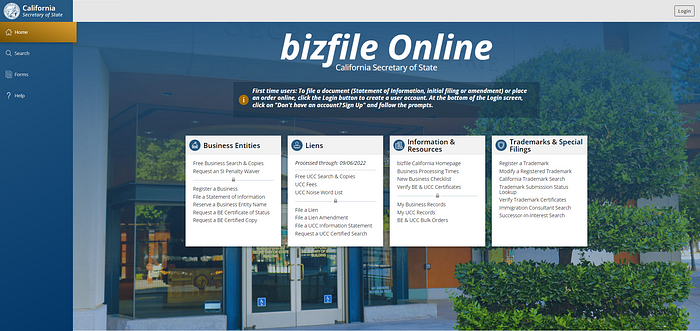

First, go to Bizfileonline.sos.ca.gov. On the left hand side, under “Business Entities” select “Register a Business.” Next, select the “File Articles of Organization” option — you’ll also see that there is a $70 fee.

Next, you will be prompted to create an online account using your first name, last name, contact info, and organization. Then you will be asked to agree to the Terms and Conditions as well as the Privacy warning here. Click that you agree and that you have read these terms, then click onto the next step.

The submitter information here is listed as being optional, but if there are any questions regarding your submission, this is the person whom the Secretary of State’s office is going to contact.

Next, confirm that you are not going to be providing any professional services because an LLC in the State of California cannot provide professional services.

Next, you’re going to be asked if you have previously reserved the name of your LLC. Unless you filed a specific name reservation previously, then your answer will be no.

Next, you’re going to type out how you would like your Limited Liability Company to be named. Keep in mind, the State of California has a few naming specifics:

- Your business’s name must end with the words Limited Liability Company, or the abbreviation “LLC” or L.L.C. You can also opt to abbreviate the words “Limited” and “Company” so that it is “Ltd and Co”.

- In the State of California, your LLC’s name may not contain the words Bank, Trust, Trustee, Incorporated, Inc, Corporation, Corp, Insurer, Insurance Company, or any other words suggesting that it is in the insurance business.

- The State of California also insists that your name cannot be misleading to the public. For example, your LLC cannot imply that it has any sort of false government affiliation, and cannot use words such as agency, commission, department, or bureau.

- Lastly, your LLC’s name cannot be similar to any pre-existing LLCs.

Next, you will be asked for a street address and a mailing address. Please note that the street address cannot be a PO. Box, it must be a physical street address — the street address can be registered to a virtual office if you have paid for that service. However, your mailing address can be listed as a PO.Box.

Next, select if you are going to have your registered agent be an individual or if it’s going to be a California registered corporate agent.

Next, specify if your LLC will have one manager, multiple managers, or if all members of your LLC will be managers.

Next, select if you would like to file this documentation immediately or if you have a specific file date in the future.

Next, it will ask you to add any additional optional attachments. In most cases, you may not have optional documents to attach, but the option is there just in case.

Next, you will be asked to review all information and documents submitted, and then you will be asked for an organizer signature. The organizer is whomever is filing this paperwork online — if you’re filing it for yourself, then that would be your name.

Next, you’ll finalize the $70 processing fee payment and specify if you want to order a certified copy. I recommend ordering a certified copy because it can come in handy as you file additional paperwork for your business later on.

Filing an Initial Statement of Information

After you have submitted the Articles of Organization online, the next step is to file your Initial Statement of Information. Every year, LLCs are required to file an updated Statement of Information with the Secretary of State.

All California LLCs are required to file an Initial Statement of Information, also known as Form LLC 12, with the California Secretary of State within 90 days of formation. This can be done online, in person, or by mail. The California Statement of Information will include your LLC’s address, registered agents name and address, and the names and addresses of all LLC members. Once your articles of organization have been processed, file this Initial Statement of Information by returning to the Secretary of State’s website.

Once again, on the left hand side, click on “File Statement of Information” locate your business, sign in, and you can complete the document online there.

Creating an Operating Agreement

The next step is to create an operating agreement. Having an operating agreement for your LLC — whether it be just one single member or multiple partners — is not only required by the State of California, but it will also ensure that you are undergoing the proper procedures to achieve the protections of a limited liability company.

First, you must outline your LLC’s organization. It needs to state clearly who its members are and how ownership is divided. Multi-Member LLCs may utilize an equal ownership structure, or they can assign various memberships different units of ownership. You must state if there will be an appointed manager, and how all members will conduct voting on business matters.

Next, you must outline the capital contributions of each member — each member who has invested a certain amount of money in the business must be listed.

Then you’ll need to identify distributions — how profits and losses will be divided amongst the members.

Next, you must outline how changes to the membership structure will be conducted in the event that a member leaves the company and roles or ownership are to be transferred.

Lastly, you need to outline your dissolution plan in the event that all the members of the LLC decide that they no longer wish to be in business.

If you are a single member LLC — meaning that it is just you with no other business partners registered to your LLC — then your operating agreement is going to be relatively simple, but it still should touch on all of these important points.

Obtaining an EIN Number

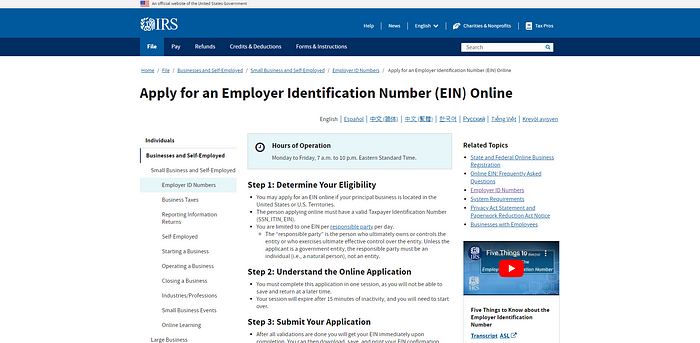

The next step is to obtain an EIN, or Employer Identification number, for yourself. Obtaining an EIN number is fast, easy, and free, and you can do so on the IRS website. You can learn exactly how to obtain one by watching the video here.

Separate Business and Personal Assets

Immediately after filing and registering your LLC, the next step is to separate your business and personal assets. It is essential that you immediately open separate business savings and checking accounts for your business name. As an LLC, you cannot mix your business accounts and transactions with your personal account and transactions — they must be completely separate.

Ensure You’re Set Up Legally

Once all of this is filed with the State of California, you must ensure that you are set up to legally operate a business within your city and your county. Visit www.CalGold.ca.gov to see what types of additional permits, licenses and fees you may need to submit. In most cases, you will need to obtain a business license, which is also known as a business tax certificate, for your specific city.

If you plan on selling tangible products, you will need to obtain a seller’s permit and remit that sales tax over to the CDTFA.

How Much Does it Cost to Register Your LLC?

So how much does it cost in total to register your LLC with the State of California?

Filing your articles of organization is a $70 fee with the Secretary of State. Filing a statement of information with the Secretary of State is $20. Keep in mind that there will be also be annual costs associated with having an LLC. Each year, you are required to file an updated statement of information which costs $20 to do so. LLCs are also required to pay an annual LLC tax to the State of California, which is $800. Also keep in mind that your annual LLC tax payment is due on the 15th day of the fourth month after your LLC registered with the Secretary of State. Fortunately, for businesses that are formed between years 2021 to 2023, the $800 annual LLC fee has been waived for their first year.

If the LLC grosses between $250,000 to $499,000 in a year, then it is required to pay an additional LLC fee of $900. Fees also range from $900 up to $11,790 depending on your business’s gross sales. This fee is due in advance by June 15 every year. The form used to submit this additional fee is form FTB 3536.

How to Maintain Your LLC

In order to keep your LLC compliant with the State of California’s laws for LLC, you’ll need to do a few things:

- Each year you’ll need to file an updated statement of information as well as submit that $20 fee in order to file it.

- Additionally, you’re going to be required to submit the $800 annual LLC tax that is due at tax time tax. And as a reminder, if your business grosses over $250,000 a year, you will be required to pay an additional LLC fee.

- Ensure that your personal and business finances are completely separate, and that you’re keeping detailed and accurate records.

Want to learn more about starting an LLC? Watch the video here!