Receiving More than $600 Through Venmo or CashApp? This New IRS Rule May Affect You & Your Business

Effective January 1, 2022, small businesses and individuals who are utilizing third party settlement organizations — which is a company that collects and submits payments to you such as PayPal, Venmo, CashApp, and others, — are REQUIRED to send you a 1099K if you had $600 or more in business related transactions in that tax year.

To understand why this change was made, you first need to understand that if you are a self employed individual or a small business owner, you are required to file income taxes if you earn $400 or more per year in net income. This means that for those individuals who are self employed — who are earning income through transactions and utilizing these third party payment processors — they can no longer fly under the radar in terms of taxation. The programs that they are using to collect their payments are now required to submit a 1099K to both the individual or small business, as well as the IRS. This means that if you, as a self employed individual, did not file your income taxes when you should have, the IRS will now know. With that being said, many are wondering how can they avoid receiving a 1099K and do so legally?

If you’re using a third party settlement organization that asks you either to create a business account or a personal account, or if the payment processor asks you to classify your transactions as either business or personal, then the third party settlement organization will only send a 1099K to the IRS with your name on it — and the matching one to you — if you’re classified as business transactions. Personal transactions that are marked as “friends and family” and are under a personal account, will not be subject to this requirement.

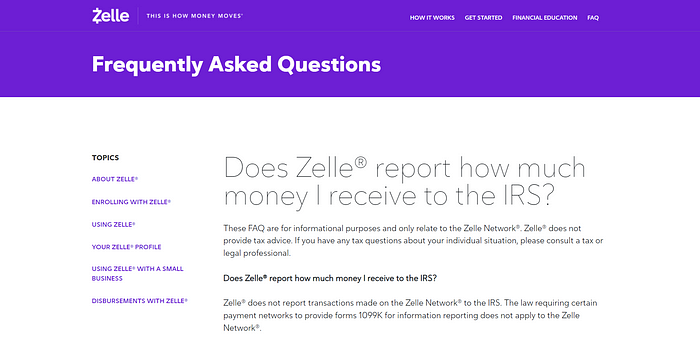

Now, there is one third party settlement organization that has stated that they are NOT sending out 1099ks at all. They will not send them to the IRS and they will not send them to you.

Zelle has stated in their documentation that they will not be sending out 1099ks, and that it is the individual or business’ responsibility to claim that income on their taxes themselves.

If you’re conducting personal transactions — exchanging money with friends or family — then you can set up a “personal” or “friends and family” account or mark your transactions as such, and you will NOT be sent a 1099K.

So does that mean that you can create personal accounts and mark your transactions as personal transactions, but still conduct business and avoid receiving that 1099K? The organizations will not send you a 1099K if you have personal accounts or transactions marked as personal; However, you still are going to be held to the IRS requirement of filing income taxes and claiming that self employment income if you have a net income (your gross amount of income minus your expenses) of $400 or more per year.

Want to learn more about the 1099K form? Watch the video here!

Please note that Ginny Silver is not a CPA, tax preparer nor attorney — please always consult with your tax professional regarding financial planning and advice.