Are you trying to figure out when you will receive your tax refund? For those of you who are filing income taxes with the IRS in 2022, you may be getting frustrated that your recent refund is delayed, late, or you’re unsure of when you’ll even receive it. You may have been told to use the “Where’s My Refund Tool” from the IRS, but here is a different tool that may help you find the answers you are looking for.

The IRS States that typically most returns receive their refunds within 21 calendar days.

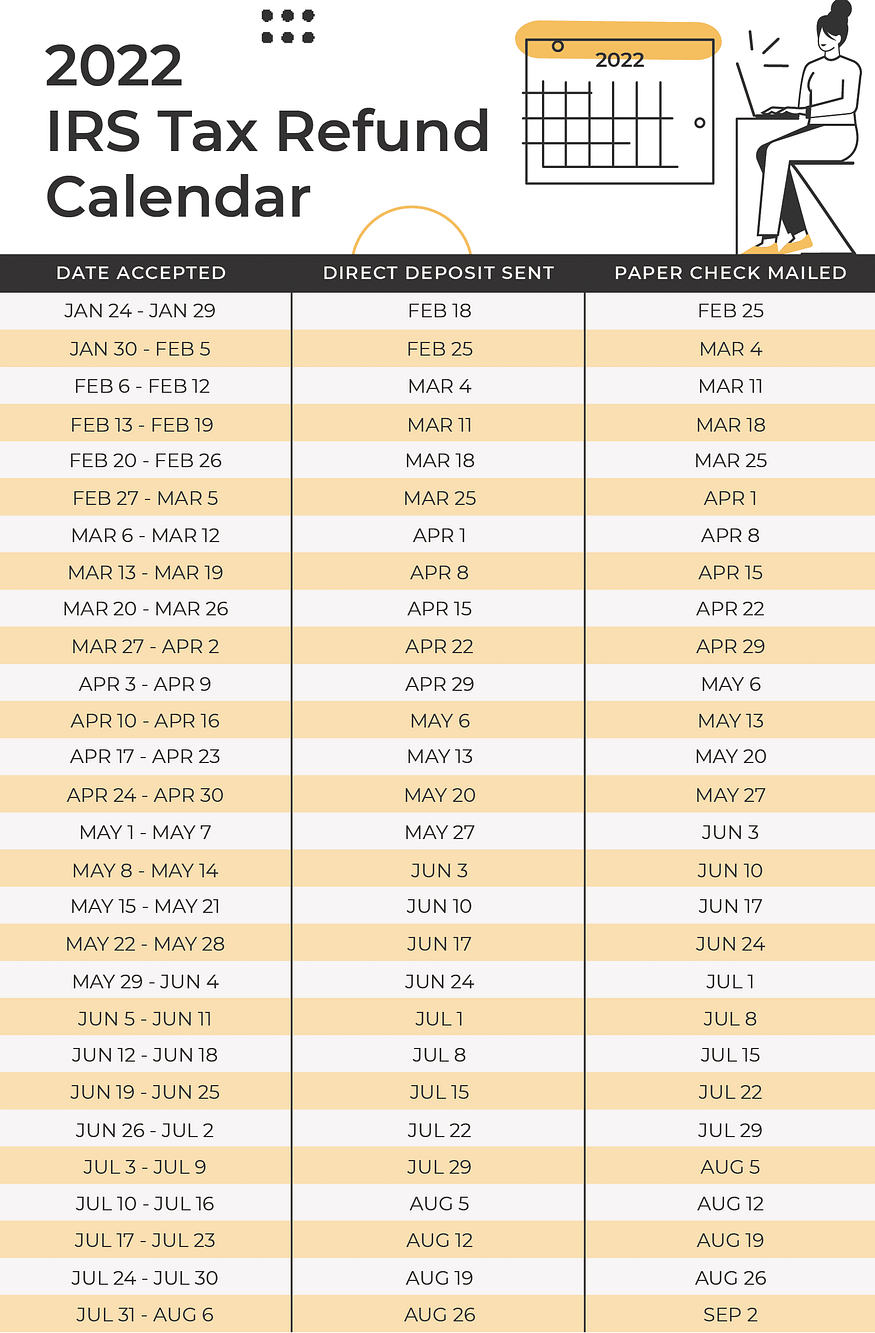

If you see a calendar like this one above, keep in mind that this is an estimation — this does not come directly from the IRS. CPAs, bloggers and organizations are putting together estimates based on IRS patterns.

Now, there are myriad of reasons why income tax refunds are delayed, and this can include things such as the IRS mounting backlog, as well as the type of credits that you claimed on your taxes and specific requirements associated with those credits. If you want to learn more about these issues that could affect your refund, click here.

Utilizing calendars such as the one above — which again, don’t actually come directly from the IRS — doesn’t quite give you all the information and it’s best to pull your transcript and see exactly what is going on. The Where’s My Refund tool is helpful for quick information, however, pulling your transcript directly from the www.IRS.gov will show you detailed updates in real time.

The IRS will either update your transcript daily or weekly depending on which type of cycle you are on. The cycle number is helpful to understand because this will tell you if you can expect either daily processing and updates to your transcript and refund, or weekly updates.

Only the first four digits correspond to the year, the next two digits correspond to the numerical week of the year, and the last two digits correspond to the IRS processing day of the week.

If the last two digits in your cycle code show 01, 02, 03, or 04, then your master files and your return are being processed and updated on a daily basis. This means that you can check your transcript daily for updates to see if your refund has been issued.

However, if the last two digits in your cycle code are 05, then your master files are not updated daily, but are being updated on a weekly basis. This means that the updates to your transcript will be delayed, and your refund will be slower to hit your bank account because the IRS is only processing it on a weekly basis. If you’re on a weekly processing basis, then your transcript master files are updated late Thursday night, and in most cases, you’ll be able to view those changes in your transcripts on Fridays.

Where’s My Refund for weekly processing accounts will only be updated on Saturdays (in most cases), and direct deposit dates for weekly accounts will most likely be on Wednesdays, whereas daily processing accounts will be updated daily.

List of Common IRS Codes

If you would like to know what each code on your transcript means, you can find the publication linked here that will explain what each IRS code entails. However, here are common codes that you may see if you are expecting to receive a refund. The Taxpayer Advocate Service lists out several of these common codes and what they mean.

One common code that is often misconstrued is Code 420. This means that your transcript has been pulled and has been assigned to the examination or appeals division, which means that something in your tax return does not quite line up, and you may be subject to an audit for further review. If you are chosen for an audit, then you will receive a specific notification about it.

The next common code that many of you may see is IRS Code 570 on your transcript. This does not mean that you have been selected for an audit, but rather that they are waiting to verify some specific things. This can vary between person to person, but things that this can include can be IRS debt ID verification, missing income statements, wage verification issues, or other complications. If you see Code 570, then you should anticipate a delay in your refund, and know that the IRS will need additional time to process your refund. You’ll know that this has cleared when you see Code 571 or 572 appear on your transcript — this means that the freeze has been lifted or reversed.

The next common code that many of you may see is IRS Code 826. This means that your refund is being utilized to pay past debts.

The code you want to see on your transcript is Code 846.This means that you have been issued a refund. However, the term “refund issued” shown on your transcript is a bit misleading because this simply means that your refund has been debited from the IRS internal system but has not necessarily been posted to your own bank account.

How to Pull Your Transcript

Firstly, head to www.IRS.gov, and log into your account. If you have not opened an account with the IRS, it’s going to take you some additional time because there are several steps that you have to complete in order to confirm your identity.

Once you’re logged into your account, you’ll see the account homepage.

- Click the “view tax records” link.

- On the next page click the “get transcript” button.

- You will then see a drop down menu asking the reasons you need a transcript. Select “federal tax” and leave the “customer file number” field empty.

- Then click the “go” button.

The next page will show you your return transcript, records of account transcript, account transcript, and wage and income transcript for the last four years.

Want to learn more about your when you will receive your tax refund? Watch the video here!